您现在的位置是:odm 28cm cast iron casserole > 综合

tin storage containers product

odm 28cm cast iron casserole2024-05-02 11:22:22【综合】6人已围观

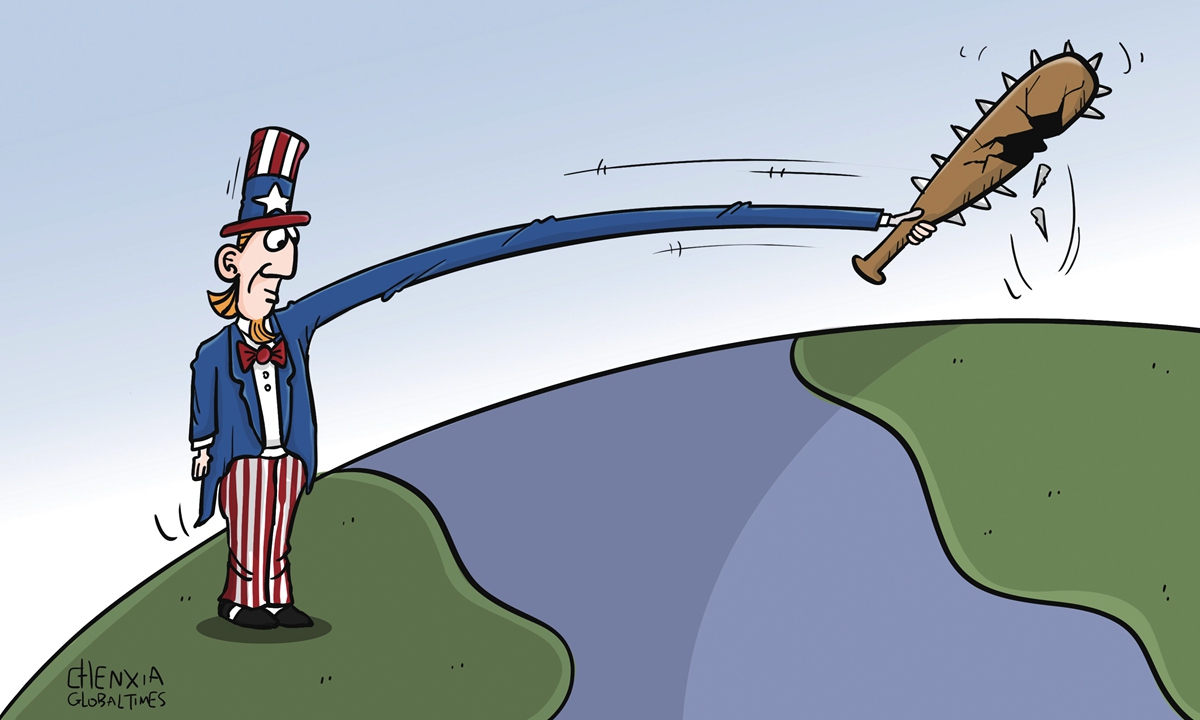

简介Illustration: Chen Xia/GTThe world's gold market is experiencing an unprecedented surge as prices so tin storage containers product

Illustration: Chen Xia/GT

Thetin storage containers product world's gold market is experiencing an unprecedented surge as prices soar to record highs, propelled by increasing bets for US monetary easing and gold's appeal as a safe haven asset. The frenzy in safe haven assets reflects rising uncertainty in the global market and anxiety shared by investors. Such worries should by no means be underestimated.Financial risks have increased as the resilience of the global financial system has been tested by multiple factors, such as unsustainable levels of debt, geopolitical confrontation, and a new era of low growth, low global investment and de-globalization. Some analysts believe these are converging to shape a unique uncertain and turbulent decade to come.

One of the most significant factors affecting the resilience of the global financial system are growing bets for a US interest rate cut. Many believe the US Federal Reserve is not very far from gaining the confidence it needs to begin cutting interest rates.

Since March 2022, the Fed has hiked its benchmark interest rate from near zero to a 23-year high of 5.25-5.5 percent to tame inflation. The Fed's interest rate increases have a ripple effect throughout the rest of the world, with developing countries bearing the brunt.

The memory of turmoil caused by the US interest rate hike cycle is still fresh for many people. At that time, a strong US dollar forced some countries to engage in competitive devaluation. Currently, the financial system is vulnerable. At the moment, it will be a second blow to the global financial markets if the US reverses the process of rate hikes and enters into a rate-cut cycle.

History tells us that US monetary easing is always one of the factors when it comes to global financial crises. Now, the situation becomes even worse, as some long-term and short-term problems are intertwined, and multiple risk factors are piling up.

With that as a backdrop, safe haven assets such as gold are sought after by investors, and the gold price continues its historic run. As reported by the Xinhua News Agency, the benchmark price for gold that is 99.95 percent pure or above stood at 529.86 yuan ($75) per gram on Monday, up 13.86 yuan from the previous trading day.

International gold prices continued their rally on Monday, reaching another record high, driven by expectations of a US interest rate cut and the metal's reputation as a safe haven asset. Spot gold increased by 0.6 percent to trade at $2,245.79 per ounce, as reported by CNBC. Prices could rise to $2,300 per ounce in the second half of 2024, especially against the backdrop of expectations that the US Fed could cut rates in the second half of 2024, CNBC reported on March 20.

The continuous rise of gold prices reflects people's anxiety and even panic toward the risks surrounding the global financial system, as well as a vote of no-confidence in US dollar-denominated assets.

International demand for US dollars and dollar-denominated assets associated with the dollar's status as an international currency is greatly affected by multiple factors like the irresponsible monetary policy of the US.

We don't know when the Fed will choose to cut interest rates, but we should be prepared for a rate cut cycle and financial risks it may cause.

In recent years, China has insisted on implementing a steady monetary policy, leaving sufficient policy space and tools in reserve to cope with new challenges and unexpected changes. The country's foreign exchange market has become more resilient. It is the resilient Chinese economy that gives us more confidence in the face of external challenges.

Challenge and opportunity are always two sides of the same coin. A rate cut by the Fed may raise fears of continued capital outflows from the US as lower interest rates mean a lower return rate on investment in US dollar-denominated assets. Some analysts believe China may become a destination for international capital inflows, because the yuan has remained relatively stable compared with other currencies, especially emerging market currencies.

Regardless of when the US gains enough confidence that inflation is under control and cuts interest rates in 2024, China has various tools to use to ensure financial stability. Its foreign exchange market is expected to maintain a relatively stable performance as the economy is on an upward trend. With increasing uncertainty in the global financial market, China can become a safe haven for international capital.

很赞哦!(12699)

热门文章

站长推荐

友情链接

- famous baking tin with lid

- white tin factory

- mints in tin can service

- custom hawaii aluminum cans

- slide tins manufacturer

- gum tin can manufacturers

- metal cookie tins factories

- wholesale man tins

- metal pencil case tin

- wholesale pencil tin

- best bulk tins

- best spice tins

- china tin pail with handle

- 7 gallon bucket companies

- tin can tin man suppliers

- candy round box company

- custom printed tins supplier

- pail container supplier

- odm food tin

- canning with cans pricelist